For most of this year I’ve been wondering what would the spark that would set off a banking panic in the European Union.

I know, but what do I do for fun, right?

I’ve chronicled the political breakdown of the EU, from Brexit to Catalonia to Germany’s bitch-slapping Angela Merkel at the ballot box. All of these things have been open rebukes of EU leadership and it’s insane neoliberal push towards the destruction of national sovereignty and identity.

And what has propped up this slow train-wreck to this point has been the world’s financial markets inherent need to believe in the relative infallibility of its central bankers.

Because without competent people operating the levers of monetary policy, this whole thing loses confidence faster than you can say, “Bank run.”

The confluence of these things with the big changes happening politically here at home with President Trump are creating the environment for big trend changes to begin unfolding.

And, as always, you have to look to the sovereign bond and credit markets to see what’s coming.

The Yield’s the Thing…

There are a couple of articles on Zerohedge this morning that paint a picture that comes into focus quite clearly. The first is the results of this morning’s 5 year Treasury Auction, which follow yesterday’s terrible 2 year bond auction.

The auction printed at a high yield of 2.245% – the highest since March 2011 – and well above last month’s 2.066% largely thank to the recent Fed rate hike. More troubling is that the auction tailed the When Issued 2.228% by a whopping 1.7bps, the biggest tail going back at least 2 years.

The term ‘tail’ is really simple, it means that the bonds were auctioned off at a higher yield (lower price) than when they were first offered.

So, two rotten treasury auctions in a row. This is indicative of foreign central banks no longer propping up the U.S. Treasury market to keep their currencies from appreciating too much versus the dollar and crushing their exports.

The second article is more complicated but it effectively shows that the credit markets are seeing huge hedging costs for Japanese Yen and Euro-based investments.

Whatever the cause behind these sharp funding shortages, one thing is clear – dollar funding costs (FX hedging costs) for both Japanese and European insurers and banks to invest in US Treasuries are surging (with Japanese buyers and reached a post-financial-crisis high of 2.35% on 15 Dec. And in terms of practical implications for the treasury market this means that, all else equal, marginal demand for US paper is about to plunge for one simple reason: the FX-hedged yields on US Treasurys have plunged to (negative) levels never seen before (unless of course foreign investors buy US Treasurys unhedged).

For the uninitiated, this reinforces what we’re seeing in the Treasury auctions, low demand for U.S. debt and high demand for U.S. dollars. If there wasn’t a high demand for dollars all of a sudden the costs to borrow in dollars wouldn’t be rising.

Simple supply and demand stuff.

Trump’s Tax Catalyst

And the catalyst for this may be Trump’s Tax Overhaul. As I said right after the tax cut package was passed, this was the greatest knife-in-the-back to someone’s political opponents since FDR’s New Deal.

But, this plan goes far beyond attacking Blue State Democrats and it’s potential to shift voter rolls. It will have massive short-term implications for European and Japanese banks that have been the holders of all of that offshore cash Trump wants repatriated.

And when Apple’s Tim Cook is talking about bringing back $282 billion in capital in 2018 alone, the banks that are holding those deposits and investments as reserves are going to have to scramble to find the dollars to redeem those investments.

Does anyone think Apple draining even just $5 billion a month from the European banking system won’t have a huge effect on the health of those banks?

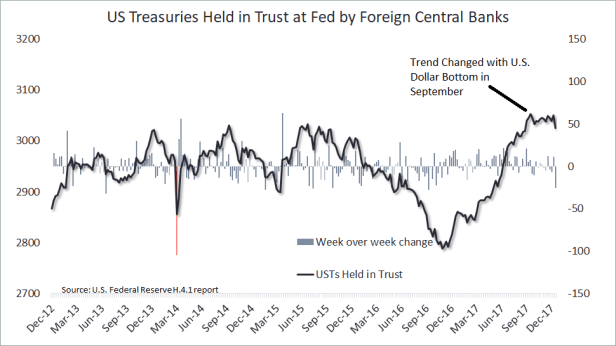

This is one of my favorite graphs. It’s simple yet it says a lot. Yes, I break down the Fed’s H.4.1 report every week (for fun).

Foreign central banks have been buying U.S. Treasuries and storing them in Trust with the Federal Reserve (meaning highly liquid) for a year now. They began buying after Trump was elected because, rightly, they expected a strong U.S. dollar from the policies he was promoting.

For most of 2017, up through September, the dollar was weak with the USDX dropping from above 104 to below 91, a huge decrease.

But, now, that trend is done. The euro has topped, the yen is weakening, and the USDX has bottomed. Note the size of this week’s outflow from the Fed’s reserves. $25.4 billion left this week.

I expect this will continue. The Treasury auctions are telling us this. The swap markets are telling us this. European Sovereign Bond yields are telling us this.

Gold’s Coal Mine

Moreover, Gold is telling us this. Gold is up over $50 off its low from earlier in the month. When the dollar bottomed in September and began to move higher, gold pulled back hard. The markets were reacting to rate hikes and shifts in foreign exchange markets normally.

Because as long as confidence in the system remains high, gold can be sold while the dollar rises. So, some early dollar liquidity problems can be offset by selling some gold along with U.S .Treasuries.

But, gold only blows through technical resistance like this (when dollars are tight) when there is real panic beginning to brew, and confidence is failing. Zerohedge is handicapping an equity market failure, whereas I see the opposite — continued rallying into 2018 as the U.S. economy absorbs higher rates, companies do stock buybacks and domestic confidence grows.

Add to that real fear in Europe as all of those dollars flee political and banking unrest in Europe and we have the makings of a barn-burner of a rally in tangible assets.

We’re closing in on $1300 gold to end 2017, a number I thought was out of reach earlier this month and advised subscribers to take advantage of seasonal gold weakness in December and rotate profits from cryptocurrencies into gold in anticipation of a Q1 rally.

I know some did just this. I may have gotten the upside numbers on Bitcoin wrong ($20,000 vs. $13,000) but that only reinforces the ideas in the post.

So, the key takeaway here is gold will be the harbinger of things going haywire. A close above $1300 this week would be a pretty good indicator that we could see a rally into the post-Brexit high of $1375 in Q1. Conversely, 2017 from a quarterly perspective is just a weak rally after the collapse post-election day.

Regardless of what happens in the next couple of weeks, these are the conditions we’ll need — tight dollars, strong gold, weak bonds — to kick off another full-blown crisis.