The news broke this morning that Litecoin developer and outspoken founder, Charlie Lee, sold or donated all of his liquid Litecoin holdings. This prompted a big sell-off in the cryptocurrency markets, putting on pause the bounce off of last night’s bottom below $16000 for Bitcoin.

This comes in the wake of Coinbase adding Bitcoin Cash (BCH) to its stable of coins available for purchase, which also sent shockwaves through the markets.

In his post on reddit, Lee explained that he felt his ownership stake was actually a burden on Litecoin’s development as a real-world medium of exchange:

And whenever I tweet about Litecoin price or even just good or bads news, I get accused of doing it for personal benefit. Some people even think I short LTC! So in a sense, it is conflict of interest for me to hold LTC and tweet about it because I have so much influence. I have always refrained from buying/selling LTC before or after my major tweets, but this is something only I know. And there will always be a doubt on whether any of my actions were to further my own personal wealth above the success of Litecoin and crypto-currency in general.

The market reacted negatively to the news but only for a short time. Litecoin under Lee’s direction has been setting itself up as the day-to-day cryptocurrency. One that is easy to use, cheap, fast and easy to pay with.

But, as a commenter on the Zerohedge article on this event pointed out, quite astutely:

It was requested from Facebook to do it so that he can’t be accused of personal interest, decision bias with regards to the LTC ecosystem development. Facebook is preparing the big announcement that they will introduce support for Litecoin as payment channel. “Digital currency exchange startup Coinbase has announced the appointment of a Facebook executive to its board of directors. In joining the board, David Marcus, vice president of messaging products at Facebook, will bring years of experience in building large-scale mobile products, according to a Coinbase statement posted yesterday.”

The article he quoted is this one from Coindesk.

And Litecoin, among the major cryptocurrencies, is uniquely positioned to be that currency for Facebook’s digital payment platform as it fills out its road-map into 2018.

It doesn’t hurt Litecoin either that with the start of trading of rival Bitcoin Cash on GDAX and buying through Coinbase that there is now potential insider trading (GASP! NO! REALLY!) around it and that trades may have to be reversed (somehow).

Market manipulation and fraud is going to be a big deal in this space going forward. The temptation to cash in and scam people is simply too high not to try and game the system to individuals’ advantage.

Lee selling his coins and publicly calling out Satoshi Nakamoto to do the same and end the potential for a whale dumping his stash and bombing the market is another sign that the Litecoin Foundation is looking to go mainstream and take cryptocurrencies out of the ‘hookers, drugs and guns’ market and into the ‘Coke and Starbucks” one.

Creating the Future

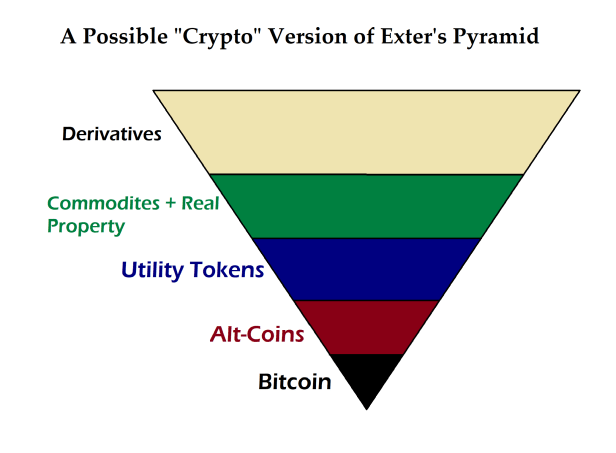

In a previous post I talked about the differentiation and segmentation occurring in the crypto-space. Bitcoin Cash with its big blocks, low fees and quick settlement times is a direct competitor to Litecoin as mediums of exchange.

Litecoin has the added payment processing layer to facilitate point-of-sale convenience while retaining proof-of-work security.

Neither, in my opinion are setting themselves up to be a reserve or foundation asset in the cryptocurrency monetary system. That’s Bitcoin’s roll. And as the money flowing into the space begins to see just how inadequate and illiquid Bitcoin is they will move into coins that are both good stores of value and retain their nimbleness and liquidity.

In fact, I expect to see at least a dozen of the current coins on the market rising to the occasion to keep the market liquid and flowing. Litecoin is just one of them.

But we are so far from that image above, the market in cryptos today is the exact opposite. Bitcoin sits at the bottom, as a massive, illiquid reserve asset. And it’s value will be converted into other coins that are capable of actually processing payments for services rendered.

In just the past four days since Bitcoin peaked near $20,000 its share of the total cryptocurrency market has plunged from over 67% to around 45% today.

Litecoin, for the first time has broken above 2% as are others, like DASH and Monero. It’s clear that the cryptocurrency market is undergoing a reorganization of capital during this phase of the bull market. And I wouldn’t be surprised to see it continue, even if there is a significant correction on the horizon.

I guess mark zuckerberg will be shortly selling all of his facebook shares, so that when he talks about facebook he can’t be accused of doing it for personal benefit.

That guy will do no such thing. I am not suggesting that Charlie Lee didn’t maximize his benefit or anything….clearly he did.